|

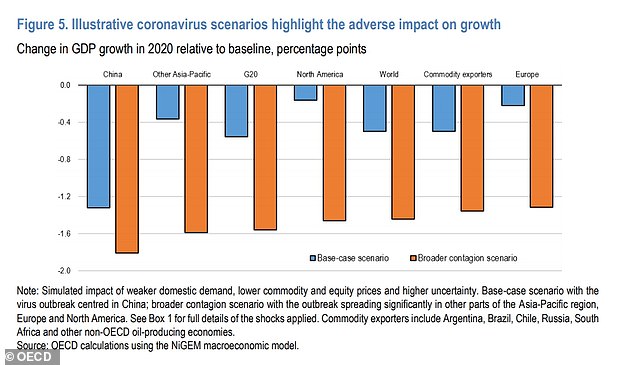

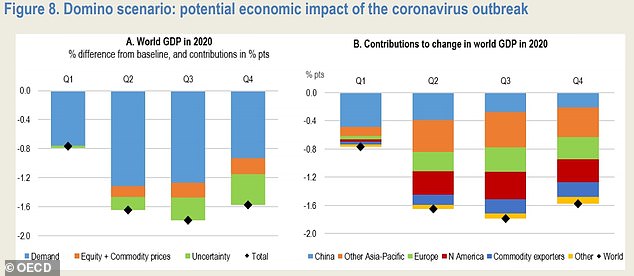

The warning saw stock markets slam into reverse after they soared into positive territory on the open amid hopes of further monetary stimulus by central banks. The FTSE 100, which shot up 2.5 per cent at the open, was down almost 1 per cent at 6,518 by midday - before then recovering to trade around 55 points up on the day at 6,636. It eventually closed up 1.1 per cent, or 74 points at 6,654.89 on Monday. 'A larger decline in growth prospects of this magnitude would lower global GDP growth to around 1½ per cent in 2020 and could push several economies into recession, including Japan and the euro area,' the OECD said. 'The overall impact on China would also intensify, reflecting the decline in key export markets and supplying economies.' If the situation does not deteriorate - with the epidemic peaking in China in the first quarter and outbreaks in other countries contained - the OECD expects global growth still to be affected, but to a lesser extent. In this scenario, it expects the world economy to grow by 2.4 per cent this year, the lowest since the depths of the financial crisis in 2009, and down from a forecast of 2.9 per cent. The UK's economic growth expectations were also slashed to 0.8 per cent, from a previous forecast of 1 per cent. In the eurozone, where the number of cases is rising fast, the economy is also seen growing by 0.8 per cent, instead of 1.1 per cent. The Chinese economy is expected to grow by 4.9 per cent, instead of 5.7 per cent, while the US by 1.9 per cent instead of 2 per cent. 'The optimism seen at the outset today in response to moves by central banks to provide support to markets already looks to have been all but wiped out following the OECD's warning shortly afterwards, said Adrian Lowcock at investment platform Willis Owen. 'The OECD has said that a "longer lasting and more intensive coronavirus outbreak" could cause economic growth to halve in 2020, to just 1.5%, and markets are now heading back down in reaction.' The OECD urged governments and central banks to fight back and avoid an even steeper slump. It comes as central banks, including the Bank of England, have signalled they would step in to protect the economy from the impact of the coronavirus outbreak. A Bank of England's spokesperson said at the weekend: 'The Bank continues to monitor developments and is assessing its potential impacts on the global and UK economies and financial systems. 'The Bank is working closely with HM Treasury and the FCA - as well as our international partners - to ensure all necessary steps are taken to protect financial and monetary stability.' The OECD also said that the trade war between the US and China and uncertainty surrounding the future of trade between the EU and the UK remain some of the biggest risks to the world economy. It noted that before the coronavirus outbreak, the world economy seemed to be stabilising, but still remained weak, mostly because of the trade war between China and the US. 'The higher tariffs imposed on US-China bilateral trade over the past two years are an important factor behind the weakness of global demand, trade and investment,' it said in the report. Going forward, apart from the coronavirus, ongoing trade and investment tensions along with the uncertainty from Brexit negotiations remain some of the biggest risks to the world economy. 'The possibility that a formal trade deal will not be agreed remains a downside risk and a source of uncertainty,' it said. 'If trade between the United Kingdom and the European Union were to revert to WTO terms after 2020, instead of a basic free trade agreement for goods as assumed in the projections, near-term growth prospects would be significantly weaker and more volatile. 'Such effects could be stronger still if preparations to border arrangements failed to prevent significant delays, or if financial market conditions and consumer confidence were to deteriorate considerably.' Source: This Is Money

0 Comments

Leave a Reply. |

Archives

February 2023

Categories |

WEBSITE MAP |

OUR SERVICES |

CONTACT US

|

© 2015 - 2024 Valores Global Pte Ltd - All rights reserved.